Quick Links

- From my Point of View

- Factors Affecting the Triangle Area Housing Market in 2025

- National Housing Market Update: Trends for 2025

- Conclusion: Looking Toward the Future

- Factors Affecting the Triangle Area Housing Market

- The US Housing Market

- The Triangle, from the Triangle MLS

- Previous years Triangle Market Data

- Finally!! The market is starting to correct- September 2022

- New Construction Market

- Buying a home from companies that bought homes for cash

- Raleigh and Triangle MLS Real Estate Market Graph for 2021

- A history of the market for 2018 to 2020 will give you a better idea of how unusual the 2021 real estate market is.

- The Raleigh and Triangle Area Real Estate Market 2018 compared to 2019

- 2019 was a strong real estate market

- Marianne’s crystal ball-Triangle Real Estate Predictions

- Cary New Construction

- Chapel Hill New Construction

- Moving to the Raleigh/Cary/Chapel Hill area?

From my Point of View

Looking at the Triangle area’s real estate market in early 2025, we’re seeing a mix of continued demand with some signs of stabilization. Mortgage rates remain a key factor in buyer behavior, with interest rates hovering around 7% to 7.5% as of January. Sellers are still cautious, holding onto their homes due to low mortgage rates, while many buyers are either hesitant due to the cost of financing or adjusting their expectations in terms of price and home features.

What’s particularly interesting is the ongoing influx of buyers relocating from other states, often with significant cash reserves from selling their homes. This has kept competition high for properties, especially in sought-after areas like Durham, Cary, and Apex. As the year progresses, there’s hope that the market will gain more balance, but for now, we’re in a period of moderate price increases and competitive conditions.

Looking ahead to the rest of 2025, the market is expected to show some signs of recovery as interest rates stabilize or even slightly decrease by mid-year. The demand for housing in the Triangle will continue, thanks to the area’s thriving economy and its appeal to both tech professionals and families.

Factors Affecting the Triangle Area Housing Market in 2025

1. Growing Demand Demand for housing in the Triangle remains strong in 2025. With major tech companies continuing to establish or expand their presence in Research Triangle Park (RTP) and strong educational institutions like Duke, UNC-Chapel Hill, and NC State, professionals and families are flocking to the region. This trend shows no signs of slowing, and the Triangle is expected to remain one of the top places to relocate to in the U.S.

2. Tech and Education Hub RTP continues to be a critical driver of real estate activity in the Triangle. In January 2025, several major companies in the tech and biotech sectors are expanding or hiring, which is expected to fuel housing demand. Additionally, universities in the region are welcoming more international and domestic students, professors, and staff, contributing to both the ownership and rental markets.

3. Inventory Fluctuations Inventory remains one of the biggest challenges in the Triangle real estate market. As of January 2025, inventory levels are still tight, although there has been a slight uptick in new listings compared to last year. Builders are working to meet demand, and some new developments are beginning to take shape in suburban areas like Holly Springs and Morrisville. However, the region still faces a significant housing shortage, particularly for entry-level and mid-range homes.

4. Price Trends In early 2025, home prices in the Triangle are seeing modest increases, but at a slower pace than in previous years. The median price for a single-family home in the area as of January 2025 is around $425,000, up approximately 3-4% compared to 2024. While this is a slight deceleration from earlier years, it’s still a sign that the market is healthy. Experts predict a continuation of moderate price increases throughout 2025, with overall price growth expected to stay in the 3-5% range for the year.

5. New Developments Development activity in the Triangle is picking up in 2025. Construction of new single-family homes, townhomes, and mixed-use developments is ramping up, especially in areas like Wake Forest, Apex, and parts of eastern Durham. The growing demand for housing and the continued influx of tech professionals and university staff are pushing developers to build more homes. By the second half of 2025, we may see a significant increase in available housing stock, which could alleviate some of the inventory pressure.

6. Rental Market The rental market remains strong, particularly in areas near universities and major employers in RTP. As of January 2025, rents have risen by approximately 5-7% year-over-year, driven by continued demand from students, faculty, and workers moving to the region. The competition for rental properties, especially in sought-after neighborhoods, is expected to remain high, though new apartment complexes and rental communities will help provide some relief by mid-2025.

National Housing Market Update: Trends for 2025

National Sales Trends in January 2025 As of January 2025, the U.S. housing market is showing signs of gradual recovery after a challenging 2023 and early 2024. New residential home sales have been modestly improving, up about 3-4% compared to this time last year. However, inventory levels are still historically low, with a continued shortage of existing homes for sale. This is leading more buyers to the new construction market, where builders are focusing on offering smaller, more affordable homes to meet demand.

Price Adjustments The national median price of a new home in January 2025 is around $415,000, reflecting a slight increase of about 2-3% from the previous year. This price trend is expected to continue throughout 2025 as the market adjusts to rising costs for materials and labor. However, analysts predict that price growth will remain moderate, particularly in markets where inventory is beginning to recover.

Mortgage Rates Mortgage rates are expected to stabilize at 6.75%-7.5% for most of 2025, which should encourage some buyers to re-enter the market. While these rates are still higher than pre-pandemic levels, they are an improvement over the rates of 2023 and early 2024, providing some relief for prospective homeowners.

Market Outlook for 2025 The U.S. housing market in 2025 will likely see continued modest growth, with a focus on affordability, especially in new construction. Markets in tech hubs like the Triangle, Austin, and Denver will continue to experience strong demand, while more affordable suburban markets could see increased interest as buyers seek lower-cost options.

Conclusion: Looking Toward the Future

The Triangle real estate market in 2025 is expected to remain competitive, with sustained demand driven by the region’s economic strength and appeal to both tech professionals and families. Though mortgage rates and inventory will continue to impact the market, we anticipate gradual price increases and more development throughout the year. As we move further into 2025, it’s crucial for buyers and sellers to stay informed about interest rates, local market trends, and inventory availability to make the best decisions.

Whether you’re looking to buy, sell, or invest in the Triangle area, staying updated on these trends will help you navigate the market with confidence.

Factors Affecting the Triangle Area Housing Market

Growing Demand: The Triangle area has been experiencing a growing demand for housing due to its robust job market, quality of life, and the presence of major universities and tech companies. This demand often leads to a competitive housing market.

Tech and Education Hub: With Research Triangle Park and several major universities like Duke, UNC-Chapel Hill, and NC State, the area attracts professionals and students, impacting the housing demand, especially in certain neighborhoods.

Inventory Fluctuations: Like many areas, the Triangle’s housing inventory can fluctuate, affecting prices and the speed at which homes sell. In recent years, there has been a trend of lower inventory, contributing to a seller’s market.

Price Trends: Historically, the Triangle has seen a steady increase in home prices, but this can vary significantly by location within the region and the type of property.

New Developments: There’s been ongoing development in the area, with new housing communities and mixed-use developments, which can influence market dynamics.

Rental Market: The rental market in the Triangle is also an important factor, particularly in areas with high student populations.

The US Housing Market

In November 2023, we’ve seen some interesting trends in the U.S. housing market. New residential home sales have decreased by 5.6% from the previous month, settling at a yearly rate of 679,000 homes. This is based on data from the Census Bureau. However, compared to last year, sales are actually up by 17.7%. The shortage of existing homes for sale is giving a boost to the new-home market.

An interesting shift is happening in the median sales price of new homes. For seven months in a row, this price has been falling, and it’s now at $409,300, which is 3.1% lower than before. Homebuilders are responding to rising costs and the need for affordability by focusing on smaller homes.

The Triangle, from the Triangle MLS

Looking at the Triangle area over the last 12 months (December 2022 to November 2023), under-contract sales have generally fallen by 9.3%. The least affected were homes priced at $470,000 or higher, where sales only dipped by 4.4%.

The overall median sales price of homes has gone up slightly, by 0.8%, reaching $395,000. Single-family homes saw the biggest price increase in this category, with a 0.5% rise to $412,000. In terms of how quickly homes are selling, the most affordable homes (priced at $244,999 or less) are moving the fastest, taking an average of 26 days to sell. Homes in the $345,000 to $469,999 range are taking the longest, averaging 30 days on the market.

Inventory levels have dropped by 3.5% across the market. Single-family homes have seen the smallest reduction in inventory, with a 4.1% decrease. This translates to a 2.6-month supply for single-family homes and a shorter 1.9-month supply for townhouses and condos.

In summary, the housing market is adjusting with a mix of decreasing new home sales, modest increases in median prices, and a tighter inventory, especially in certain price ranges.

Previous years Triangle Market Data

Finally!! The market is starting to correct- September 2022

Prices haven’t come down but I am seeing more homes on the market and some staying on the market longer. My clients are able to make offers and get a house although it is still competitive. In the past year it was very hard for a well qualified buyer to get a house unless they had cash and were will willing to put up huge due diligence funds, often in the amount of the down payment and provide an appraisal addendum that the buyers would and could pay the difference between the appraised value and purchase price.

New Construction Market

New construction neighborhoods are starting to advertise inventory with no bidding. Builders are finishing homes in a more reasonable time frame than the past two years and custom builders are starting to price homes before they are complete because they are feeling more confident of pricing.

Buying a home from companies that bought homes for cash

One thing I have noticed that “buy your home for cash companies” like Open Door and Mark Spain over paid for homes using their logarithm not taking into account the difference in neighborhoods and home quality, so make sure you check neighborhood comps before buying one of those listings. The price reductions may look like a good deal but usually aren’t because the original list price was too high.

A look at 2021 Triangle Area Home Prices

Cary, Apex_Morrisville 2021 prices up 27.7%

Fuquay-Varina_Holly Springs prices up 27.5%.

Orange County prices down in 2021

Chatham County prices rising 2021

Raleigh and Triangle MLS Real Estate Market Graph for 2021

A history of the market for 2018 to 2020 will give you a better idea of how unusual the 2021 real estate market is.

January 2019 compared to 2020

Homes for Sale in the Triangle

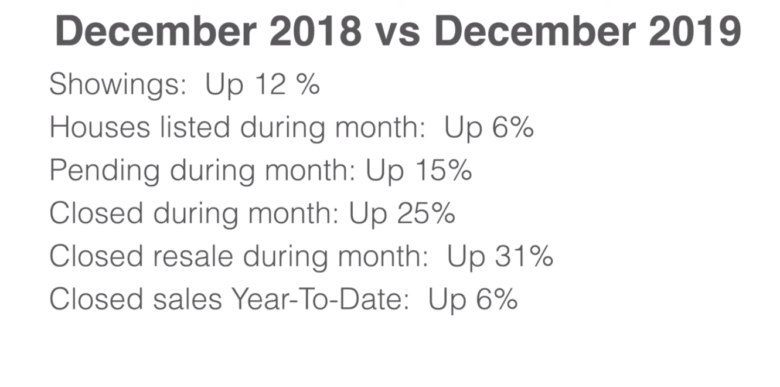

The Raleigh and Triangle Area Real Estate Market 2018 compared to 2019

In the video from the Triangle MLS real estate appraiser Stacey Anfindsen compared 2018 with 2019.

2019 was a strong real estate market

2019 Was one of my best years ever. One of the reasons is that the area is growing. I represented buyers from 11 different states in 2019. Four families moved from California. Other popular states for relocation were New York, New Jersey, Massachusetts and Florida. Even though inventory is low clients seem happy with the choice of homes, especially if they have time to build a new home.

Marianne’s crystal ball-Triangle Real Estate Predictions

Crystal Ball is Broken!

Cary New Construction

Chapel Hill New Construction

Moving to the Raleigh/Cary/Chapel Hill area?

If you are moving to the Triangle in Chapel Hill/Carrboro, Cary, Morrisville, Apex or Holly Springs I can help you understand the market and the micro markets and can represent you as your buyers agent. I will be happy to send you videos of the home/neighborhood. This is especially helpful if you are considering new construction because the online info is limited.

Call Me! Marianne Howell Wright 919-274-4365

Marianne Howell Wright, Triangle Area Real Estate 919-274-4365 [email protected]